Australian housing market stable with upside in 2026

One of the things I look closely at when banks release their earnings is the delinquency rate. The rate at which loans are turning bad, or late repayments turning into defaults.

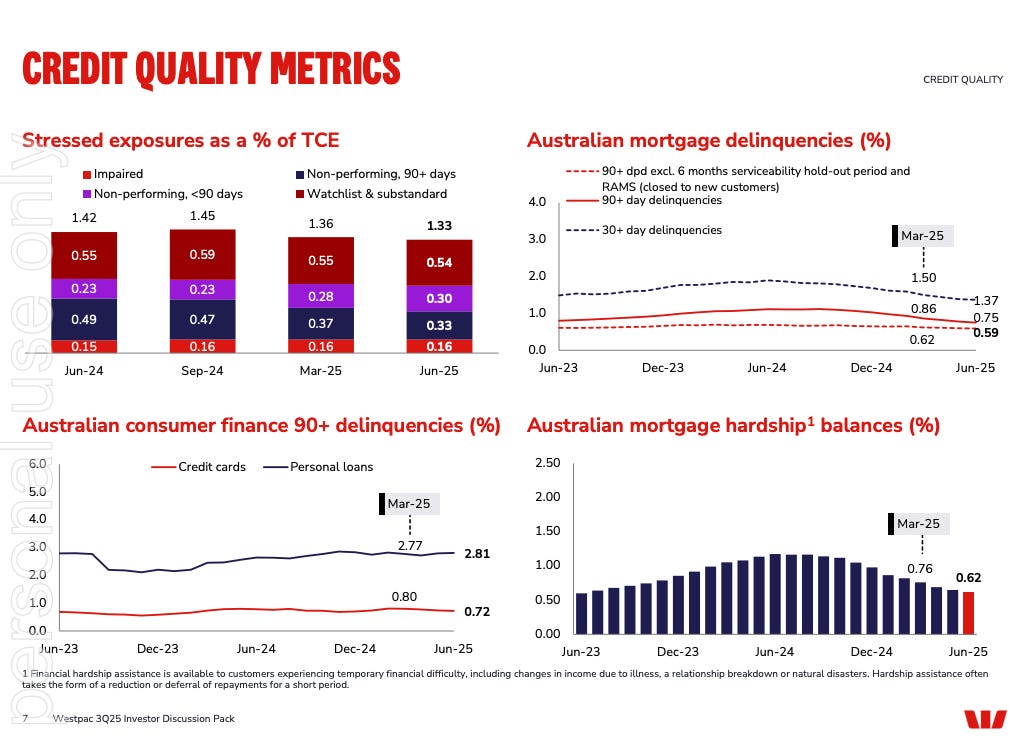

I look at the arrears trend. These are loans which are late but not yet in full default. Westpac’s numbers show 90-day arrears are trending lower, which is a good sign for the housing market. They’ve fallen from 0.86% to 0.75% — which means 99.25% of mortgages are in a reasonably good shape.

Same story with 30 day arrears. Employment is strong, property prices are stable and rates are coming off a little.

The balancing act seems to have paid off for the RBA, reducing inflation while maintaining the financial system is strong. If you’re a geek like me and want to see the full Westpac profit numbers, they’re here.

While many may cringe at the record profits of the big banks, I actually think it’s a positive. A strong banking system is good for everyone. It’s good for the millions of Australians who own banking shares in the superannuation funds.

And it’s especially good for everyday property investors who rely on credit to finance their investments.

The key property markets I think do well next year are those where population, investments in infrastructure and employment is growing. I break this down further in my recent podcast episode, explaining how each of these components impacts property prices over the long term.